itpl.site

Overview

Block Chain Investment

Blockchain Capital. About · BCAP Build · Blog · Fund Reviews · Jobs · Portfolio · Team. Latest. READ ARtICLE. BSX: Powering fund reviewsinvestor portal. The Global X Blockchain ETF (BKCH) seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies. We invest in equity and token projects and provide them with legal, security, technical, and financial support from our talented bench of employees, partners. Impact tokens and blockchain technology offer promising solutions to mobilizing investments toward the Sustainable Development Goals by addressing the. Buy an ETF that specifically invests in shares of companies with exposure to blockchain. Two notable examples are Amplify Transformational Data Sharing ETF . On Republic, anyone can invest in startups. Become an investor in cutting-edge private companies with as little as $ These funds invest in cryptocurrencies, cryptocurrency futures contracts, or equities related to cryptocurrencies. You can find them in the Morningstar category. Cryptocurrency is a digital payment system that doesn't rely on banks to verify transactions. It's a peer-to-peer system that can enable anyone anywhere to send. 7 Blockchain Stocks to Invest In · 1. Nvidia · 2. Block · 3. IBM · 4. Mastercard · 5. Amazon · 6. Coinbase Holdings · 7. GlobalX Blockchain ETF. Blockchain Capital. About · BCAP Build · Blog · Fund Reviews · Jobs · Portfolio · Team. Latest. READ ARtICLE. BSX: Powering fund reviewsinvestor portal. The Global X Blockchain ETF (BKCH) seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies. We invest in equity and token projects and provide them with legal, security, technical, and financial support from our talented bench of employees, partners. Impact tokens and blockchain technology offer promising solutions to mobilizing investments toward the Sustainable Development Goals by addressing the. Buy an ETF that specifically invests in shares of companies with exposure to blockchain. Two notable examples are Amplify Transformational Data Sharing ETF . On Republic, anyone can invest in startups. Become an investor in cutting-edge private companies with as little as $ These funds invest in cryptocurrencies, cryptocurrency futures contracts, or equities related to cryptocurrencies. You can find them in the Morningstar category. Cryptocurrency is a digital payment system that doesn't rely on banks to verify transactions. It's a peer-to-peer system that can enable anyone anywhere to send. 7 Blockchain Stocks to Invest In · 1. Nvidia · 2. Block · 3. IBM · 4. Mastercard · 5. Amazon · 6. Coinbase Holdings · 7. GlobalX Blockchain ETF.

Investor demand is driving the growth of cryptocurrency. Help grow your practice and aim to meet your clients' long-term investment goals. camera icon. Re-. We also look at how market participants — such as investors, technology providers and financial institutions — will be affected as the market matures. A. As such, this is very similar to other private equity investments made by Fairfax's three retirement systems. No more than 15% of the funds will be invested in. Companies and individuals are increasingly considering initial coin offerings (ICOs) as a way to raise capital or participate in investment opportunities. The most straightforward way to invest in a blockchain is to buy the associated cryptocurrency. Every time you purchase Bitcoin or Ether, you are making an. A single investment accesses global, diversified exposure to leading early stage blockchain venture investments on an institutional platform. Spot cryptocurrency represents the most common investment, with Most institutional investors believe in the long-term value of blockchain and crypto. Reduced Costs and Efficiency – Blockchains can oftentimes more efficiently process transactions and circumvent extraneous fees. Using the prior example. a16z crypto is a venture capital fund that has been investing in crypto and web3 startups — across all stages — since In the quickly emerging virtual and decentralized world of blockchain, crypto assets, and tokenization, trust is more important than ever. investment, legal. But you can buy shares of companies that use and develop the technology, invest in a blockchain exchange-traded fund (ETF) to gain exposure to a group of. Invest In Blockchain is your source for the latest crypto news, investment opinion, and informative, engaging content on blockchain education! While not all cryptos are same, they all pose high risks and are speculative as an investment. You should never invest money into crypto that you can't afford. Companies and individuals are increasingly considering initial coin offerings (ICOs) as a way to raise capital or participate in investment opportunities. Global Markets & Investment Banking. Helping companies, investors, and industry trailblazers navigate the crypto and digital asset economy. The AI/Blockchain Investment Support Programme aims to strengthen the European blockchain ecosystem and to develop strategic partnerships with key stakeholders. Cryptocurrency Risks · Facts About Paying With Cryptocurrency · Facts About Investing with Cryptocurrency · Protect Your Money and Avoid Investment Scams · Investor. Invest in cryptocurrencies and the underlying blockchain technology via the innovative VanEck products so as to diversify your portfolio. Leverage J.P. Morgan's blockchain expertise to solve complex business challenges, commercialize digital applications and develop custom use cases. blockchain services to manage online payments, accounts, and market trading. For example, Singapore Exchange Limited, an investment holding company that.

Renters Insurance Shared House

property or natural disaster. For most roommates, experts recommend separate renters insurance policies for each person sharing an apartment or rental home. Renters insurance can help you replace stolen or damaged property. Learn Do Not Sell or Share My Personal Information (CA residents only) WA My. We'll shed some light on renters insurance and roommates, explain why most insurers won't let you add roommates to your policy, and let you know what to watch. Does Renters Insurance Cover Accidental Damage or Tenant Damage? Does Renters Insurance Cover Accidental Damage To TV? References. We know that every tenant wants to get great value on contents insurance, so we offer competitive prices and customisable cover to help manage the cost. And, even if your homeowners or renters insurance includes coverage for home-sharing or rentals, your insurance company still could deny your coverage. That's. OP just needs to be okay with accepting liability for the other parties faults and diminished coverage for personal property if the limit needs. Tenant Liability Insurance financially protects you if someone is unintentionally injured in your home, or if you've damaged someone else's property. With this. Yes, you can get renters insurance in a shared household, and it's possible to share a policy with a roommate. property or natural disaster. For most roommates, experts recommend separate renters insurance policies for each person sharing an apartment or rental home. Renters insurance can help you replace stolen or damaged property. Learn Do Not Sell or Share My Personal Information (CA residents only) WA My. We'll shed some light on renters insurance and roommates, explain why most insurers won't let you add roommates to your policy, and let you know what to watch. Does Renters Insurance Cover Accidental Damage or Tenant Damage? Does Renters Insurance Cover Accidental Damage To TV? References. We know that every tenant wants to get great value on contents insurance, so we offer competitive prices and customisable cover to help manage the cost. And, even if your homeowners or renters insurance includes coverage for home-sharing or rentals, your insurance company still could deny your coverage. That's. OP just needs to be okay with accepting liability for the other parties faults and diminished coverage for personal property if the limit needs. Tenant Liability Insurance financially protects you if someone is unintentionally injured in your home, or if you've damaged someone else's property. With this. Yes, you can get renters insurance in a shared household, and it's possible to share a policy with a roommate.

Renters insurance (sometimes referred to as "tenant insurance") helps cover unexpected events — otherwise known as covered perils. You may not always be able to. In certain situations, both roommates could be legally liable if something happens at the shared residence. Can I Buy Renter Insurance if I'm renting a House. property damage while on your property if you include liability insurance. Renters' insurance often protects your belongings when you aren't at home as well. Renters insurance protects your personal property against damage or loss, and insures you in case someone is injured while on your property. A standard renters insurance policy will not only cover your tenant's personal belongings in case of a covered loss, such as a house fire, but will also provide. Some contents insurance providers may refuse a tenant who lives in shared accommodation or they might exclude more items, especially if bedroom doors don't have. A Florida renters insurance policy, aka an HO4 Tenant Homeowners policy, provides the protection you need for your personal property. Yes, you can get renters insurance in a shared household, and it's possible to share a policy with a roommate. However, this might not always. Renters insurance is a form of property insurance that provides coverage for a policy holder's belongings and liability within a rental property. Your household insurance policy (aka, your renters or homeowners policy) That said, while renters insurance might cover some portion of shared items. If your roommate is a Named insured, you both benefit from the liability and personal property. You typically can only have two Named insureds. This can become even stickier when you have a shared policy. Renters liability insurance provides coverage if you are found legally liable for causing property. Learn about renters insurance for roommates: from civil liability to personal property protection share the responsibilities that come with an apartment! Having a separate policy would also ensure each roommate has liability coverage for protection if someone gets injured in the home or apartment. Shared Policies. Your household insurance policy (aka, your renters or homeowners policy) That said, while renters insurance might cover some portion of shared items. The amount of coverage available for certain personal property and other losses is generally related, by percentage, to the amount for which the dwelling is. If you rent your home, having renters insurance is a no-brainer: It protects Working with your insurance agent, price out a shared policy versus a single. In order to avoid disputes arising from damage to the renter's belongings, many landlords require a tenant to buy renters insurance before signing a lease. Next. Landlord's insurance does not cover the personal property of any tenant living on site. How Renters Insurance Works. Insurance policies cover different types of. Each tenant doesn't need their own policy, but adding roommates to renters insurance can get tricky in terms of coverage details.

How Much Is A Subscription To Headspace

Headspace costs $ per month and $ per year. The monthly subscription includes a seven-day free trial, and the yearly subscription includes a two-week. Subscription issues. If the promo code doesn't work, please reach out to Revolut Support via the in-app chat. For any other issues subscribing to Headspace. But I fell off of it and am now just picking it up again since they have a student yearly subscription that is only $10/yr. At normal prices it. When you join the AMA, you can choose to receive up to 1 year of Headspace access for free.* Meditation and mindfulness have been shown to help people stress. After your free trial, the annual subscription is $ USD and automatically renews each year. Are you a post-secondary or university student? More from Headspace ; Yearly Subscription · $ ; Subscription · $ ; Headspace Gift Subscription · $ ; Gift Some Headspace · $ After that you can continue using that program indefinitely, or you can subscribe for $ per month for the entire program. They offer a. Can I get a refund? If you purchased a Headspace Plus annual subscription on itpl.site within 30 days, you can contact teamsupport@headspace. You'll get access to Headspace for [$ USD, €, £, $ AUD, $ CAD, $ MXN] a year while you're a verified college or university student. Headspace costs $ per month and $ per year. The monthly subscription includes a seven-day free trial, and the yearly subscription includes a two-week. Subscription issues. If the promo code doesn't work, please reach out to Revolut Support via the in-app chat. For any other issues subscribing to Headspace. But I fell off of it and am now just picking it up again since they have a student yearly subscription that is only $10/yr. At normal prices it. When you join the AMA, you can choose to receive up to 1 year of Headspace access for free.* Meditation and mindfulness have been shown to help people stress. After your free trial, the annual subscription is $ USD and automatically renews each year. Are you a post-secondary or university student? More from Headspace ; Yearly Subscription · $ ; Subscription · $ ; Headspace Gift Subscription · $ ; Gift Some Headspace · $ After that you can continue using that program indefinitely, or you can subscribe for $ per month for the entire program. They offer a. Can I get a refund? If you purchased a Headspace Plus annual subscription on itpl.site within 30 days, you can contact teamsupport@headspace. You'll get access to Headspace for [$ USD, €, £, $ AUD, $ CAD, $ MXN] a year while you're a verified college or university student.

As a note, the monthly option is the only subscription billed on a month-to-month basis. Discount codes and gift codes can only be used when you purchase via. Now you can experience Headspace for free as long as you have a library card. How do I get started using Headspace? Sign up during one of the open enrollments. More from Headspace ; Yearly Subscription · $ ; Subscription · $ ; Annual Subscription · £ ; Gift Some Headspace · $ Can I still enroll if I already have a Headspace subscription with a personal account? How long will I have access to Headspace with this free subscription? What does the Headspace Family plan offer? The Headspace Family plan offers complete access to the Headspace Library for up to 6 family members for $ a. If you need help choosing a plan or subscribing, please contact our team. Need more help? Email us at [email protected] Was this article helpful? With the Premium Headspace annual subscription you have access to all meditations and mindfulness exercises in Headspace's app. In it you will find Meditation. See instructions below. I'm already a Headspace Plus Member and have paid my annual subscription. Can I get a refund? If you purchased. Subscription options: $/month, $/year. These prices are for United States customers. Pricing in other countries may vary and actual charges may be. Free Headspace premium membership is available to Syracuse University students on a first-come, first-served basis and provides the opportunity to grow. If you get the yearly subscription with the day free trial, it's about half the price ($ per month), compared with the monthly subscription with a 7-day. 4 answers to question "Hi 'Headspace' app users, can you suggest me some cheaper way to get subscription from 'Headspace'?:P". As a way to make a useful tool available to those who need it most, university students are eligible for Headspace's student offer, reducing the normal. Headspace Care before their dependents can sign-up. How much do the Headspace Care services cost? There's no cost to use the coaching and skill-building. Headspace annual subscription is $ a year, or $ for every month. How I Use It. Generally, I use headspace only for meditation in. I'm already a Headspace Plus Member and have paid my annual subscription. Can I get a refund? If you purchased an individual membership directly through the. Headspace offers free Headspace Plus subscriptions · to all K teachers Join · now to get access to live Q&A's with · experts, tips, advice, & access. Available to all BSW employees and family members at no cost Headspace is meditation made simple. The app teaches you life-changing skills of meditation and. A monthly and annual subscription is available along with a free trial, so you can try out the app for free before you financially commit. Headspace is a user-. More from Headspace ; Yearly Subscription · $ ; Subscription · $ ; Headspace Gift Subscription · $ ; Gift Some Headspace · $

Investing In Private Equity

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private equity is an alternative investment that includes any type of equity that isn't listed on a public stock exchange. Learn more about how it works. There are several specific risks in private equity investing, given the inherently illiquid nature of the investments and the need to lock-up capital for. Private equity strategies generally involve investing in companies that are not publicly traded on stock exchanges. We are proud of Blackstone's role as a positive economic catalyst for the companies in our Corporate Private Equity portfolio. We work to identify, invest in. Private Equity International provides unparalleled global private equity news and analysis focused exclusively on the LP/GP nexus. Investment in direct lending in general looks like a good investment with relatively low volatility and quite steady annual returns of ~10% (with a couple. A private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors. The Fund column lists the names of all active partnership investments. Vintage Year is the year in which CalPERS' first cash flow for the investment occurred. The emergence of public companies competing with private equity in the market to buy, transform, and sell businesses could benefit investors substantially. Private equity is an alternative investment that includes any type of equity that isn't listed on a public stock exchange. Learn more about how it works. There are several specific risks in private equity investing, given the inherently illiquid nature of the investments and the need to lock-up capital for. Private equity strategies generally involve investing in companies that are not publicly traded on stock exchanges. We are proud of Blackstone's role as a positive economic catalyst for the companies in our Corporate Private Equity portfolio. We work to identify, invest in. Private Equity International provides unparalleled global private equity news and analysis focused exclusively on the LP/GP nexus. Investment in direct lending in general looks like a good investment with relatively low volatility and quite steady annual returns of ~10% (with a couple. A private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors. The Fund column lists the names of all active partnership investments. Vintage Year is the year in which CalPERS' first cash flow for the investment occurred. The emergence of public companies competing with private equity in the market to buy, transform, and sell businesses could benefit investors substantially.

Private-equity capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel. EquityZen is the marketplace for accessing Pre-IPO equity. Invest in or sell shares via EquityZen funds. Investment in direct lending in general looks like a good investment with relatively low volatility and quite steady annual returns of ~10% (with a couple. Private equity funds are pools of capital to be invested in companies that represent an opportunity for a high rate of return. They come with a fixed investment. 1. Higher returns. One of the main reasons for introducing private equity into a portfolio is the potential to raise the overall portfolio return. Broadly, a co-investment is an investment in a specific transaction made by limited partners (LPs) of a main private equity (PE) fund alongside. There are several specific risks in private equity investing, given the inherently illiquid nature of the investments and the need to lock-up capital for. Secondary funds, commonly referred to as secondaries or continuation transactions, purchase existing interests or assets from primary private equity fund. This innovative program provides an ideal combination of lectures by Wharton finance faculty and Wharton alumni who are leaders in the private equity industry. Private equity firms will typically look to hold investments for between four and seven years, at which time they will look to sell, or 'exit', their stake. Private equity investment is characterized by a buy-to-sell orientation: Investors typically expect their money to be returned, with a handsome profit, within. Moonfare is a private equity investing platform making top-tier funds available to retail and institutional investors at lower minimums. As part of a diversified investment portfolio, private equity is consistently the highest returning asset class for public pensions, delivering median. Alpine Investors is a people-driven private equity firm that is committed to building enduring companies. We are invested globally in funds, secondaries and directly in private equity. By applying our comparative advantages – scale, certainty of assets and our long. The Private Equity (PE) team is building a global, diversified portfolio designed to outperform comparable passive public alternatives over the long term. We are proud of Blackstone's role as a positive economic catalyst for the companies in our Corporate Private Equity portfolio. We work to identify, invest in. Private equity funds can buy companies that are already private, or they may take a controlling interest in publicly traded companies and take them private by. Responsible investment is naturally aligned to private equity and venture capital through its long-term investment horizon and stewardship-based style. Co-investments, typically alongside private equity managers, offer sophisticated institutional investors and high net-worth individuals the opportunity to gain.

Best Affordable Dental Insurance Plans

MetLife is an excellent option for dental insurance with no waiting period for basic care. MetLife's no-waiting-period dental insurance plans cover 65% of basic. Find the Best Dental Insurance for You Welcome to itpl.site We make comparing dental insurance plans easier to accomplish for employers, families. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. Our dental insurance plans include discounts on dental procedures, no waiting periods, various choices for maximum benefits (up to $), low lifetime. Family dental plans include dental benefits for adults as well as pediatric dental benefits. If only adults or both adults and children need dental coverage. Price: Low to High, Price: High to Low, Newest, Oldest. Apply. Membership · Overview Travel Medical Insurance Plans · Away from Home · Group Medical Services. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Dental Family PPO Insurance Plans · Low deductible · Diagnostic and preventive services covered at % with no waiting period · Pediatric essential health. Looking for an affordable dental plan that gives you great value? The Preferred Prime dental insurance plan is the most popular Delta Dental insurance plan. MetLife is an excellent option for dental insurance with no waiting period for basic care. MetLife's no-waiting-period dental insurance plans cover 65% of basic. Find the Best Dental Insurance for You Welcome to itpl.site We make comparing dental insurance plans easier to accomplish for employers, families. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. Our dental insurance plans include discounts on dental procedures, no waiting periods, various choices for maximum benefits (up to $), low lifetime. Family dental plans include dental benefits for adults as well as pediatric dental benefits. If only adults or both adults and children need dental coverage. Price: Low to High, Price: High to Low, Newest, Oldest. Apply. Membership · Overview Travel Medical Insurance Plans · Away from Home · Group Medical Services. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Dental Family PPO Insurance Plans · Low deductible · Diagnostic and preventive services covered at % with no waiting period · Pediatric essential health. Looking for an affordable dental plan that gives you great value? The Preferred Prime dental insurance plan is the most popular Delta Dental insurance plan.

Discover all the Manulife health and dental insurance plans available to Queen's University alumni at affordable rates benefits best suited for you and the. Some dental insurance plans have annual maximums as low as $1,, depending on the plan and provider.5 Once your dental bills exceed $1, in any given year. Compare dental insurance plans from Florida Blue. Each of our affordable dental plan options gives you the quality coverage you need to stay healthy. Dental Coverage. All health plans include dental care for children at no extra cost. For adults, a dental plan can be added to your health plan purchase. Health plans with dental coverage: Some Marketplace health plans have dental coverage. You can see which plans include dental coverage when you compare them. Top 4 Things to Know About Supplemental Dental Insurance. It's easy to spend hundreds, even thousands, on dental care; and. Family dental plans include dental benefits for adults as well as pediatric dental benefits. If only adults or both adults and children need dental coverage. Best dental insurance plans of August ; Anthem · Best dental insurance. ; Guardian · Best dental insurance for dentures. ; Ameritas · Best dental insurance for. If you're looking for a dental insurance plan that's most affordable for you, you'll find a variety of options with UnitedHealthcare branded dental plans. Dental Blue® for Individuals℠ has 3 great options that provide the coverage you need at an affordable price. Preventive PPO. Good for people focused on. Our Personal Health BasicPlan can start as low as $ per month*. It can be paired with our optional Dental Care coverage to give you the dental benefits you'. Discover dental insurance plans in Ontario. Having good oral hygiene is an essential part of maintaining optimum physical health. That's why it's important to. California · California dental plans as low as $ per month. Delta Dental, Spirit Dental, California Dental Network, Denali Dental and more · California dental. Dental plans are offered as part of our workplace benefits, helping you provide affordable dental coverage that Canadians can count on. Choosing the best dental insurance depends on individual needs, required coverage and budget. Companies like Manulife, Blue Cross, and SunLife offer a. How much does dental insurance cost in New York? · Are stand-alone pediatric dental plans on the exchange ACA-compliant? · Which insurers offer dental coverage. cost of services when you use the plan. Compare and shop dental insurance plans online to find the best dental plan for your dental care budget and needs. EasyDentalQuotes offers low cost dental plans for Austin families and singles. We partner with top dental carriers like Delta Dental and Nationwide Insurance. CAA offer various insurance plans to protect you and your family from For all of life's big events, trust us to make sure you've got the best coverage for you. Our Dental coverage plans are flexible and affordable, so you can support Coverage like this will help attract and retain the best talent for your.

What Does Wix Cost

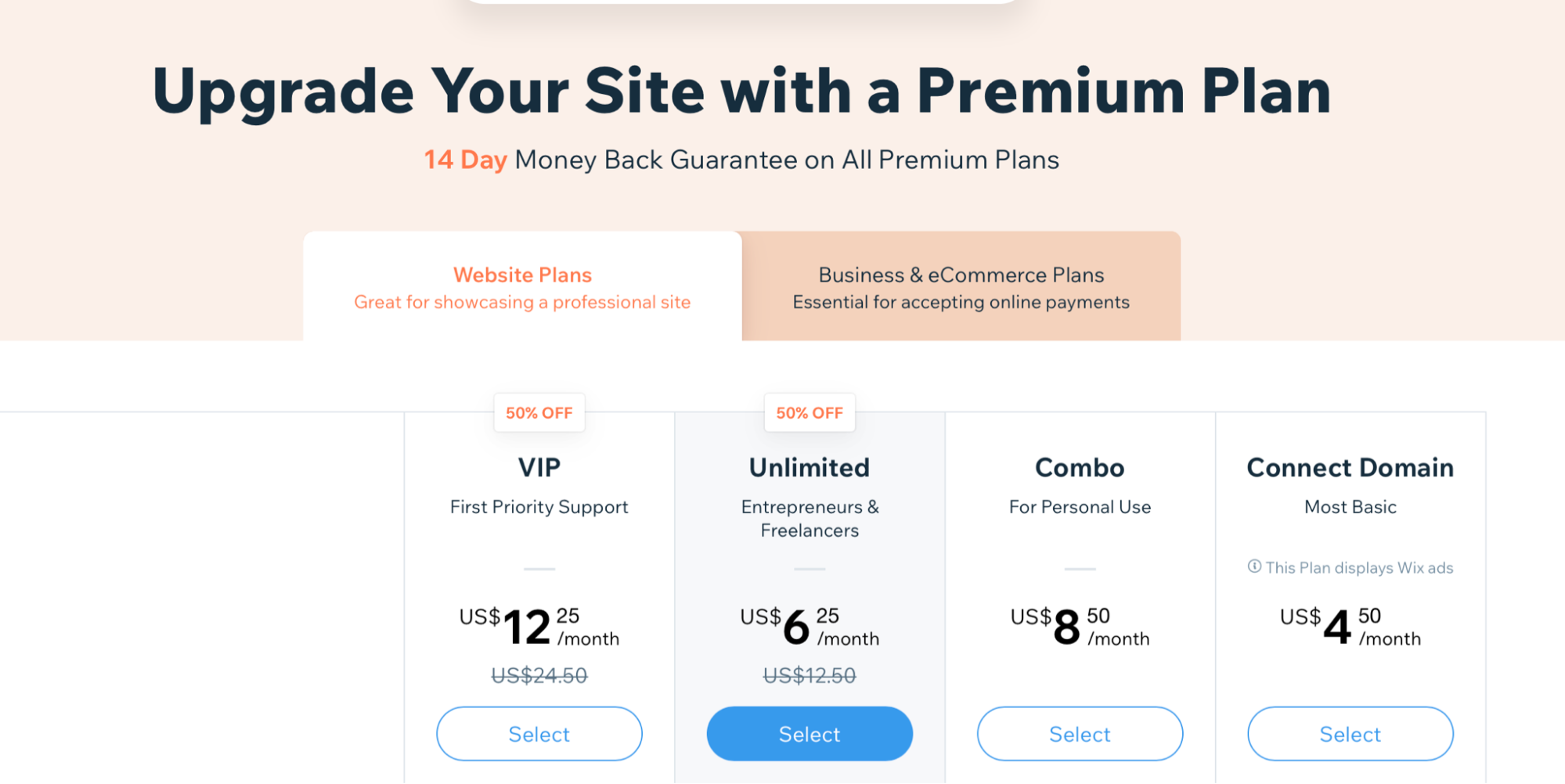

The cost of creating and maintaining a professional site with Wix is $14 - $39 a month depending on which website plan you're going to choose. Wix has 4 pricing editions, from $16 to $ Look at different pricing editions below and see what edition and features meet your budget and needs. If you build a website with Wix, your annual maintenance costs are just your annual paid plan's renewal cost - so anywhere from $17 a year. Wix rates range from $14 to $+ per month (billed annually). The Combo plan is the most affordable at $14 per month and includes an ad-free website, whilst. What is a Premium plan? What is a Premium plan? ; Can I try a Wix Premium plan for free? Can I try a Wix Premium plan for free? ; How do I get my free domain? How. There are a total of eight paid plans, which are started from $16 per month. In contrast, the highest pricing plan of Wix is $59/ month. The clients will get a. The cheapest way to create your website with Wix is with their Combo Plan. At $ a month, you will be able to create your website and have your own domain. Pricing · Wix Owner App · Wix Studio · Enterprise. English. Deutsch · English How do I know if an enterprise solution is right for my business? The Wix. Wix offers several annual eCommerce plans ranging from $27/month for basic eCommerce features to $/month for more advanced capabilities. The cost of creating and maintaining a professional site with Wix is $14 - $39 a month depending on which website plan you're going to choose. Wix has 4 pricing editions, from $16 to $ Look at different pricing editions below and see what edition and features meet your budget and needs. If you build a website with Wix, your annual maintenance costs are just your annual paid plan's renewal cost - so anywhere from $17 a year. Wix rates range from $14 to $+ per month (billed annually). The Combo plan is the most affordable at $14 per month and includes an ad-free website, whilst. What is a Premium plan? What is a Premium plan? ; Can I try a Wix Premium plan for free? Can I try a Wix Premium plan for free? ; How do I get my free domain? How. There are a total of eight paid plans, which are started from $16 per month. In contrast, the highest pricing plan of Wix is $59/ month. The clients will get a. The cheapest way to create your website with Wix is with their Combo Plan. At $ a month, you will be able to create your website and have your own domain. Pricing · Wix Owner App · Wix Studio · Enterprise. English. Deutsch · English How do I know if an enterprise solution is right for my business? The Wix. Wix offers several annual eCommerce plans ranging from $27/month for basic eCommerce features to $/month for more advanced capabilities.

How much does Wix cost? Wix offers various pricing plans to cater to different needs. The Combo plan is the cheapest at $12 per month and is great for. Wix offers two kinds of website plans: those meant specifically for business, including ecommerce, and those that aren't. Here's what they cost. itpl.site is the place for managing all of your website projects. There's no need to juggle a dozen platforms and logins. You can have your domains, Wix, Google. Wix Website Pricing · Wix's prices start at $ monthly for the Connect Domain plan. Wix goes up to $ a month if you opt for the VIP upgrade. · Squarespace. Wix offers five different packages, starting at $16 per month and reaching up to $ per month (or higher for Enterprise packages.). If you decide to build a site from scratch, you'll need to pay for hosting separately, the costs of which can range from $ to $ per month, depending on. Displayed prices are for yearly subscriptions, paid in full at the time of purchase. Prices do not include applicable taxes, which are determined according to. As its name suggests, this plan strikes an intriguing middle ground among Wix pricing plans. At a monthly cost of $29, the Core plan offers far. They do offer monthly pricing or annual whichever you prefer. If you wish to host elsewhere maybe look at using webflow or another platform. Wix is one of the best website builders on the internet and it has affordable plans. See our breakdown of Wix pricing for Creating a website on your Wix Studio workspace is free. Upgrading a site with a Wix Studio plan gives the site Premium features such as connecting a custom. With Wix, shared web hosting is free with every site. Other website builders and hosting providers may charge anywhere from US$2 and up, a month. Premium apps are available on the Wix App Market from both Wix and third parties, with prices typically ranging from around $3 to $15 a month. Storage Isn't. As I mentioned before, Wix comes with 7 pricing plans, The Combo plan is the cheapest and starts at 11 USD per month with the Business VIP being the most. Premium apps are available on the Wix App Market from both Wix and third parties, with prices typically ranging from around $3 to $15 a month. Storage Isn't. Pricing · Wix Owner App · Wix Studio · Enterprise. English. Deutsch · English How do I know if an enterprise solution is right for my business? The Wix. Wix has 4 pricing edition(s), from $16 to $ Look at different pricing editions below and read more information about the product here to see which one is. How much does a Wix domain cost? The pricing of a Wix domain typically spans from $10 to $45 per year, with specific domains occasionally bearing a slightly. Some Wix apps can be used for free but others must be purchased. The price ranges between $3 and $ The prices shown do not include applicable taxes that are. Wix pricing starts at 16 USD per month. While there is a free version, Wix does not offer a free trial. See additional pricing details below.

Easy Ways To Build Credit Fast

A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Your credit utilization measures the amount of debt you have as a percentage of your credit limits. If you're maxing out your credit cards, lenders see that as. Get a secured card. Pay all bills early and in time. The car loan will help. Get a credit savings and checking account. You can take out a small. If you make on-time payments, applying for different types of credit can help you build credit faster and improve your overall credit score. That's because a. Get a secured card. Pay all bills early and in time. The car loan will help. Get a credit savings and checking account. You can take out a small. 4 key credit moves for somethings · Pay your bills on time and in full · Consider tools to help establish credit · Don't use all your credit · Check your credit. The Case With Credit. · Consider a secured credit card · Look into a credit-builder loan · Find a co-signer · Become an authorized user · Don't overspend. Consider setting up automated payments for recurring bills to make it easier. Keep your credit card balances as low as you can. Ideally, you should pay your. Your monthly bills like utilities can help build credit. Get a secured card. Pay all bills early and in time. The car loan will help. Get a. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Your credit utilization measures the amount of debt you have as a percentage of your credit limits. If you're maxing out your credit cards, lenders see that as. Get a secured card. Pay all bills early and in time. The car loan will help. Get a credit savings and checking account. You can take out a small. If you make on-time payments, applying for different types of credit can help you build credit faster and improve your overall credit score. That's because a. Get a secured card. Pay all bills early and in time. The car loan will help. Get a credit savings and checking account. You can take out a small. 4 key credit moves for somethings · Pay your bills on time and in full · Consider tools to help establish credit · Don't use all your credit · Check your credit. The Case With Credit. · Consider a secured credit card · Look into a credit-builder loan · Find a co-signer · Become an authorized user · Don't overspend. Consider setting up automated payments for recurring bills to make it easier. Keep your credit card balances as low as you can. Ideally, you should pay your. Your monthly bills like utilities can help build credit. Get a secured card. Pay all bills early and in time. The car loan will help. Get a.

Set-up automatic payments with your bank if this helps. Paying your bills on time every month will dramatically help to improve your credit rating. This means. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute credit report errors. 1. Pay off or consolidate debt · 2. Get a secured credit card · 3. Ask for a credit limit increase · 4. Become an authorized user · 5. Get a secured loan · 6. Get a. The Case With Credit. · Consider a secured credit card · Look into a credit-builder loan · Find a co-signer · Become an authorized user · Don't overspend. The Case With Credit. · Consider a secured credit card · Look into a credit-builder loan · Find a co-signer · Become an authorized user · Don't overspend. Secured Credit Card A secured credit card is an effective way to build credit if you are unable to qualify for a regular credit card or a student card. The best way is, ironically, to increase your debt. You might try asking a parent or relative to co-sign a loan. The sooner you can buy. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. Credit cards are the easiest ticket to establishing credit and improving your score. You can use them at nearly every store and online site, pay for public. Ways to build credit · 1. Understand credit-scoring factors · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured credit card. Find a co-signer. Another helpful way to build credit is by having a co-signer for certain loans, with the co-signer being responsible for the full loan amount. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. Opening a credit card, becoming an authorized user and applying for a credit-builder loan are some ways to establish credit. · Building good credit relies on. Rapid rescoring typically takes three to five business days to complete and is generally most helpful when someone is actively evaluating your credit scores. Paying on time is one of the best ways to boost your score. Credit utilization ratio. The way debt affects your credit score is more about how you use debt and. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. To improve your credit score fast, ask for higher credit limits, open new loans to improve your credit utilization, become an authorized user on another credit. Student credit cards and store-specific credit cards can also help you build credit and may be easier to get than regular cards. Pay in full and on time. Credit.

What Is Prime Rate Of Interest Today

The current prime rate is %. It last changed on July 27, Data source: Wall Street Journal (print edition). Current and Historical Data. Mortgage rates refer to the interest you pay on your home loan. It's the cost your lender charges you for borrowing the money, just like the interest rate on a. The current Bank of America, NA prime rate is % (rate effective as of July 27, ). The prime rate is set by Bank of America based on various factors. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. % – Effective as of: September 17, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. The bank sets a range of interest rates for each loan type. The rates individual borrowers are charged are based on their credit scores, income, and current. U.S. prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks, and is effective 7/27/ Other prime rates aren't. If your current ARM is tied to the SOFR (Secured Overnight Financing Rate) you interest rates that are tied to the prime rate. For example, a US Bank Prime Loan Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. The current prime rate is %. It last changed on July 27, Data source: Wall Street Journal (print edition). Current and Historical Data. Mortgage rates refer to the interest you pay on your home loan. It's the cost your lender charges you for borrowing the money, just like the interest rate on a. The current Bank of America, NA prime rate is % (rate effective as of July 27, ). The prime rate is set by Bank of America based on various factors. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. % – Effective as of: September 17, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. The bank sets a range of interest rates for each loan type. The rates individual borrowers are charged are based on their credit scores, income, and current. U.S. prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks, and is effective 7/27/ Other prime rates aren't. If your current ARM is tied to the SOFR (Secured Overnight Financing Rate) you interest rates that are tied to the prime rate. For example, a US Bank Prime Loan Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %.

Graph and download economic data for Bank Prime Loan Rate Changes: Historical Dates of Changes and Rates (PRIME) from to about prime. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Prime Rate ; Bank of North Dakota Base Rate · % · 07/27/ See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/ The prime rate is the underlying index for most credit cards, home equity loans and lines of credit, auto loans, and personal loans. Prime Rate and Member Rate Index ; %, %, %, % ; %, %, %, %. Selected Interest Rates · 1-month, , , , , · 2-month, , , , , · 3-month. Fees and Prime Interest Rate. Fees · Request Document Remediation - Fees · Prime Interest Rate · Request Document Remediation - Prime Interest Rate. The. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. The current prime rate among major US banks is %. The prime rate normally runs three percentage points above the central bank's federal funds rate. Rate posted by a majority of top 25 (by assets in domestic offices) insured US-chartered commercial banks. Prime is one of several base rates used by banks. If the prime rate rises, the interest rates on your loans and adjustable-rate credit cards will rise as well. Second, the prime rate affects liquidity in the. interest rates will be on September 18, Prime Rate Definition. The U.S. Prime Rate is a commonly used, short-term interest rate in the banking system of. The current U.S. prime rate is %, having risen from % on July 27, To stay up to date with the current prime rate, visit The Wall Street Journal . Today's Rates · % · Explore Products and Rates. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! “The prime interest rate is essentially the lowest variable rate a bank can offer its best customers, but in reality, the rates offered will often be higher,”. That means that when the Fed raises interest rates, the prime rate also goes up. You can find the current prime rate on the Wall Street Journal website. Bank Lending Rate in the United States is expected to be percent by the end of this quarter, according to Trading Economics global macro models and.

Financial Planner Richmond

As a Financial Planner, Investment & Retirement Planning at BMO Financial Group, I can help you define your financial objectives and develop a personalized. Stratview Wealth Management is an office of Northwestern Mutual based in Richmond, VA. Using creative strategies, comprehensive financial planning and. Plan, Build and Secure Your Wealth. Are You a Wealth Builder? Get Your Free Wealth Builder Score in under three minutes! For those already in retirement, successful financial planning includes wealth management strategies and legacy planning. James River Gives. Everything you need from insurance to investments to financial planning, all in one place. Get in touch with your Richmond, VA Northwestern Mutual financial. Financial Planning firm in the Central, Eastern and Shenandoah Valley regions of Virginia. Richmond, Virginia in For years, we have. Our advisors ; Dean Frechette. Investment Advisor ; Jacky Wong. Portfolio Manager & Investment Advisor, Financial Planner ; Kent Chen. About Our Richmond Office. When you come to our financial planning office you can feel secure and confident right from the beginning. That is because our. At Vancity, our team of experienced, accredited investment professionals are available to provide you with strategic advice and financial solutions. As a Financial Planner, Investment & Retirement Planning at BMO Financial Group, I can help you define your financial objectives and develop a personalized. Stratview Wealth Management is an office of Northwestern Mutual based in Richmond, VA. Using creative strategies, comprehensive financial planning and. Plan, Build and Secure Your Wealth. Are You a Wealth Builder? Get Your Free Wealth Builder Score in under three minutes! For those already in retirement, successful financial planning includes wealth management strategies and legacy planning. James River Gives. Everything you need from insurance to investments to financial planning, all in one place. Get in touch with your Richmond, VA Northwestern Mutual financial. Financial Planning firm in the Central, Eastern and Shenandoah Valley regions of Virginia. Richmond, Virginia in For years, we have. Our advisors ; Dean Frechette. Investment Advisor ; Jacky Wong. Portfolio Manager & Investment Advisor, Financial Planner ; Kent Chen. About Our Richmond Office. When you come to our financial planning office you can feel secure and confident right from the beginning. That is because our. At Vancity, our team of experienced, accredited investment professionals are available to provide you with strategic advice and financial solutions.

Find and learn more about a financial advisor near you from the Merrill Lynch Wealth Management Branch Office in Richmond, VA We are financial advisors who put clients first, backed by a firm that does the same. At the heart of every financial plan is a person. Fee-Only Financial Advisory in Richmond, VA & Williamsburg, VA. Stuart Certified Financial Planner Board of Standards Center for Financial Planning, Inc. Financial Freedom Planners™ was founded by Charles Roberts, a Certified Financial Planner™ professional, based on his personal and professional experience. McLeod Mooney Certified Financial Planning is an experienced and locally owned financial services firm specialized in managing Group RRSPs and Pension Plans. IMPACT FINANCIAL is a registered investment advisor based in Virginia, serving clients nationwide. CFP® offering fiduciary, fee-only services. Top 10 Best Financial Planner in Richmond, VA - September - Yelp - Tom Love, CFP, CRPC, CRPS, Financial Freedom Planners, Virginia Estate and. Collaborative financial planning and advice for entrepreneurs and executives local to the Richmond, Charlotte, and Orlando areas and across the United States. At Ray Olson Family Financial Planning we are committed to helping retirees and pre-retirees in Richmond Virginia area make smart decisions about their. Vancouver financial planner / financial advisor providing award-winning financial advice with a focus on tax efficiency. Top-rated on Google. financial advisory firm helping individuals and families in Richmond, VA and nationwide. We specialize in: Financial planning and wealth management; Tax. Richmond VA. Limited clientele so that we remain available, responsive, and focused. Services: financial planning, investments and wealth management. Find a financial advisor in the Richmond, VA area. Review the verified advisors below. Visit their websites. Contact them directly. Ask lots of questions. Financial Planning · Investment Management · (k) Investment Alexis Advisors, LLC (“Alexis Advisors”) is an investment adviser in Richmond, VA. Valeo Financial Advisors based in Richmond is a fee-only financial planner, Fiduciary Financial, providing personal tax planning, investment management. Our firm analyzes your financial plan to figure out which investments are best for your unique situation. Richmond, VA, Virginia Beach, VA. Name. This field. Mark Fonville, CFP® is a CERTIFIED FINANCIAL PLANNER™ practitioner and financial advisor in Richmond and Williamsburg, VA. Find out how Mark helps. Financial Freedom Planners offers objective, affordable, fee-only financial planning and investment advice you need to get on your road, reach your goals. financial professionals at Welcome Home Financial Partners, located in Richmond, Virginia Wealth Advisors an Investment Advisor in the State of Virginia. The.

Easiest Way To Switch Banks

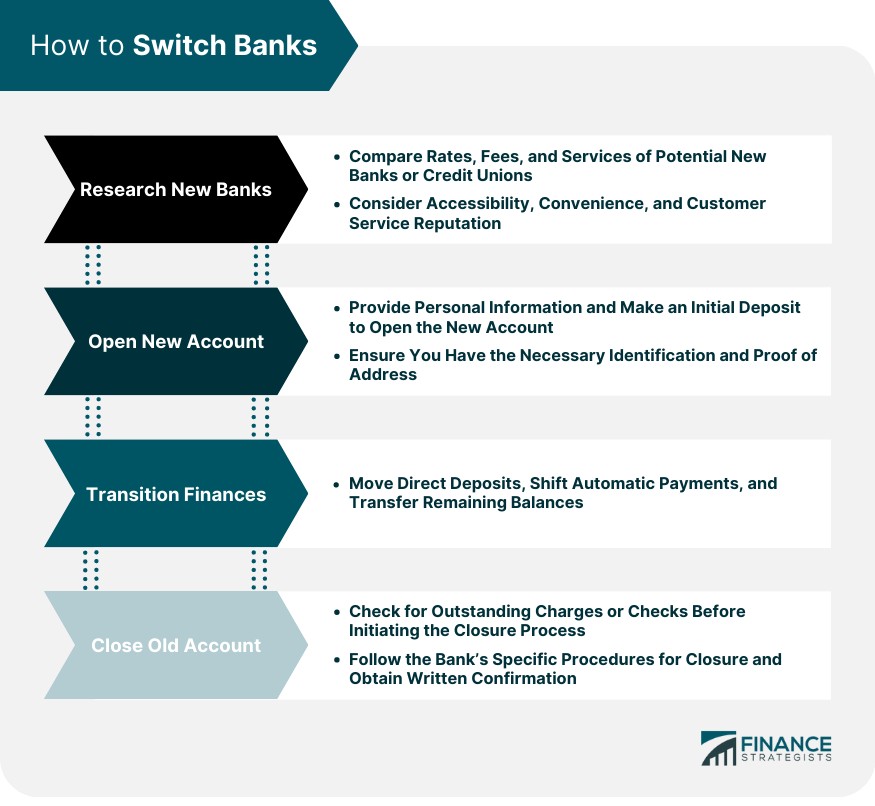

Saying goodbye is easier than you think · Get started with First · Open your new account. · Move your payments & deposits. · Close your old account. One of the easiest is of course to pull your money out at a Wells Fargo branch, close your account, then walk into a new bank and deposit your. Offline- Visit Bank Branch and submit an application for transferring accounts. Online- In the case of SBI you can apply online for transferring. Have you switched all your direct deposits and automatic payments? Have all your checks, debit card purchases, transfers, or automatic payments cleared your old. Offline- Visit Bank Branch and submit an application for transferring accounts. Online- In the case of SBI you can apply online for transferring. How to change banks · 1. Compare your current bank account with others · 2. Open your new account · 3. Make a list of all your direct debits and direct credits · 4. To move these automatic payments to your new account, contact the billers directly. Fortunately, many make it easy to switch payment methods online. Then. The easiest way to switch banks is to make a plan before touching any of your money. Sit down and think about all of the deposits, withdrawals, transfers. How to switch or close a bank account · Using the Current Account Switch Service (CASS) · Using the Current Account Switch Service (CASS) · Switching with an. Saying goodbye is easier than you think · Get started with First · Open your new account. · Move your payments & deposits. · Close your old account. One of the easiest is of course to pull your money out at a Wells Fargo branch, close your account, then walk into a new bank and deposit your. Offline- Visit Bank Branch and submit an application for transferring accounts. Online- In the case of SBI you can apply online for transferring. Have you switched all your direct deposits and automatic payments? Have all your checks, debit card purchases, transfers, or automatic payments cleared your old. Offline- Visit Bank Branch and submit an application for transferring accounts. Online- In the case of SBI you can apply online for transferring. How to change banks · 1. Compare your current bank account with others · 2. Open your new account · 3. Make a list of all your direct debits and direct credits · 4. To move these automatic payments to your new account, contact the billers directly. Fortunately, many make it easy to switch payment methods online. Then. The easiest way to switch banks is to make a plan before touching any of your money. Sit down and think about all of the deposits, withdrawals, transfers. How to switch or close a bank account · Using the Current Account Switch Service (CASS) · Using the Current Account Switch Service (CASS) · Switching with an.

How to switch banks in 6 steps · Step 1: Research bank account options · Step 2: Select your new bank · Step 3: Open a new bank account · Step 4: Take an inventory. We'll help you get started banking with Wells Fargo. Make the switch in three steps after opening your new account. Switching banks is easy with Bank of America, from opening your account to transferring direct deposits. Learn how to switch banks online today. Once you've switched the payments and deposits over to your new bank, make sure to check your list for any forgotten payments. This is an easy step to overlook. Switching banks is easy with Bank of America, from opening your account to transferring direct deposits. Learn how to switch banks online today. To move these automatic payments to your new account, contact the billers directly. Fortunately, many make it easy to switch payment methods online. Then. To simplify the process of changing banks, go through your bank statements and search for those types of deposits and payments. How to Make the Switch to a New Bank · Research banks and choose the right one for your needs: · Open and fund the account: · Switch direct deposits and automatic. Have you switched all your direct deposits and automatic payments? Have all your checks, debit card purchases, transfers, or automatic payments cleared your old. To simplify the process of changing banks, go through your bank statements and search for those types of deposits and payments. If you want to go the in-person route, call the bank you're going to switch to, make an appointment and ask them what you need to bring to seamlessly open a new. How to switch or close a bank account · Using the Current Account Switch Service (CASS) · Using the Current Account Switch Service (CASS) · Switching with an. Steps for Transferring Money Between Banks · Log into your bank's website or connect via the bank's app. · Click on the transfer feature and choose transfer to. How to switch banks · 1. Choose a new bank · 2. Open a new bank account · 3. Link your bank accounts · 4. Update any automatic payments · 5. Wait a month · 6. If you have bills that are coming up while you're switching, it may be easiest to switch those after they debit from your existing account. You can use this. You can likely transfer funds from your old one to make that initial deposit. Some bank accounts require no initial deposit if you sign on with direct deposit;. Once you're sure all payments have successfully switched and your balance is zero (or close to it), it's time to bid adieu to your old bank. Some banks allow. Four steps to switching your business checking account. 1. Open an account. Open and fund a new business checking account with Wells Fargo. Transferring banks is easy and secure with Capital One. Learn how to switch your bank account, and move your money and automatic bills over to your new. Once you're sure all payments have successfully switched and your balance is zero (or close to it), it's time to bid adieu to your old bank. Some banks allow.